It’s freshers’ week! If you’re a student off to uni or college, great for you! You are going to have an amazing time and see your life change in so many ways over the next few years.

This is also the best time of your life to really get a grip on your money stuff. Whether you’ll be living away from home for the first time, or returning in third year with mountains of debt, it could not be more important to take a few minutes to think about how you’re managing your money.

Seriously – learning how to budget or discovering a few essential money-saving tools now could save you THOUSANDS over the course of your degree!

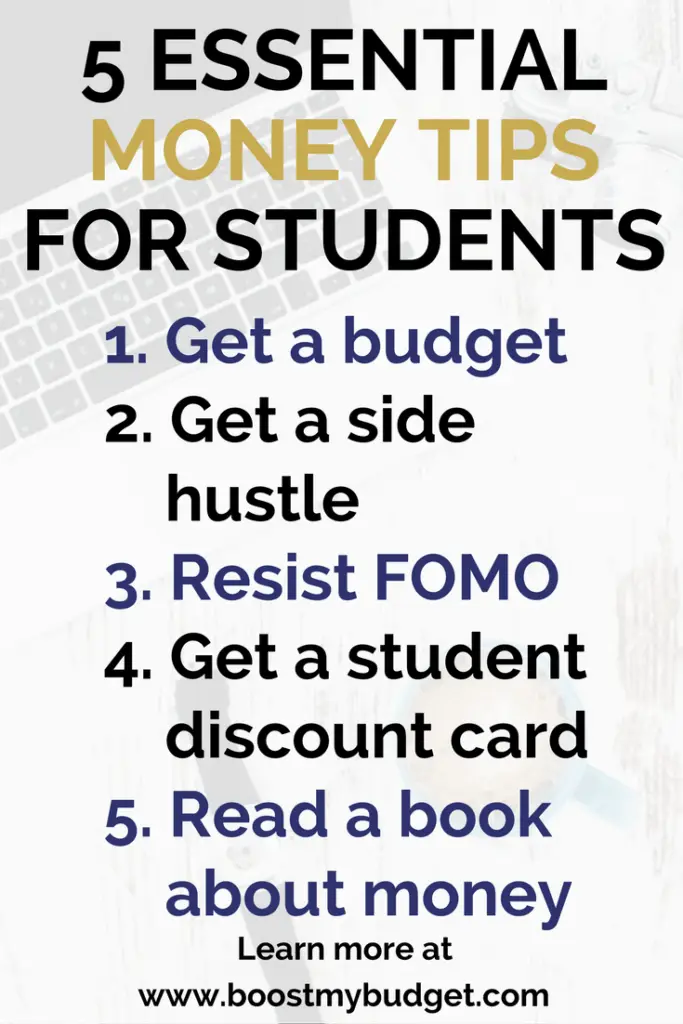

If you’re wondering how to improve your finances, here are my top 5 money tips for students. Even just one of these will have a massive impact on your bank balance, now and for years to come!

Get a budget

In my first year at uni, I had no idea what I was doing with money.

I remember getting a student loan at the beginning of the first semester and it felt like I was the richest I’d ever been in my life! I didn’t really think about how I was going to make it last for weeks. It was also the first time I’d been in charge of my own food shopping and generally looking after myself, and I had no concept of how much to spend.

The result? I was in my over

draft by Christmas.

The single best thing you can do for your finances is learn to budget.

No, don’t run away! I’ve only been budgeting for a couple of years but it has changed my life.

People often think budgets will be restrictive and boring, but I’ve found the complete opposite. My budget gives me freedom because I know exactly how much I can spend on things guilt-free (yes, you’re allowed to budget for fun stuff too!)

It also takes away so much stress when you know exactly how much money you have and have a plan for spending it.

I use a budgeting tool called YNAB (You Need A Budget) and I honestly cannot recommend them highly enough! The system is designed to be completely flexible, so no worries about overspending one month. There’s a desktop software and a corresponding app, which makes it super easy to record expenses on the go.

There’s a small fee for most users, but students can use YNAB for free for your first year. So you’ve got nothing to lose – try it out today, and thank me later!

Get a side hustle

Saving money is good, but making money is even better!

Depending on your course, you probably have more free time now than ever. Why not put it to good use and start investigating ways to earn extra money online? Whether you need money to supplement your living expenses, pay for nights out or save for a holiday, we could all use a bit of extra cash.

Of course, there are always the student staples like getting a job in a bar or a coffee shop, but I’m (obviously!) a huge fan of making money online! If you start now, you could even be earning enough to put off getting a job in the real world by the time you graduate.

Luckily for you, I’ve published a master post of over 29 Legit Online Jobs For Students.

It contains loads of ideas for earning extra cash. All of these are great for students because they’re completely flexible, meaning you can work any time of day or night, or take a break altogether during exam period or holidays.

If you don’t want to read the full post, here are some of my top picks:

- Matched betting (very lucrative side hustle for residents of the UK and Ireland only)

- Make money with surveys

- Learn how to make money on Pinterest with affiliate marketing

- Set up a money-making website based around your hobbies or interests (no tech knowledge required)

- Test websites from home

- Set up a home business selling on Amazon

If you’re not 18 yet, your options are a little more limited, but I have plenty of ideas in my post on online jobs for teenagers.

Learn to say no

Look, I know how it is.

In the build up to uni, the focus is more on the going out than the studies. In your first few days you will pick up hundreds of flyers and hear about dozens of parties. The pressure is intense.

But you need to learn to conquer the FOMO.

Saying yes to everything will not only rinse out your bank account, it’s also just not good for your physical or mental health.

Don’t think that you have to say yes to every invitation because these are ‘once in a lifetime experiences’ or ‘how you make connections’ or something.

They’re not. There are plenty of cheaper and more effective ways to bond with new friends than going out getting drunk. There are loads of fun things to do without spending money at all.

Having a cup of tea in halls or cooking a meal with your new flatmates is where the real connections happen. Look after your bank balance and yourself, and have a night in once in a while.

If going out to restaurants is more your style, take a look at my post on how to save money eating out.

Get a student card ASAP

As soon as you register at university, you should send off for an NUS Extra card (if you’re in the UK). The NUS card costs just £12 per year and gives you discounts at hundreds of places from restaurants and shops to coach tickets. This could save you HUNDREDS over the length of your course.

Also, if you’re planning to do some travelling, look into the International Student Identity Card (ISIC), for similar deals all over the world. You get one year free with your NUS Extra membership. The ISIC is especially handy for flights, hostels and hotels. You can also use it as proof of student status to get reduced entry to museums and other attractions.

Psst… not a student, but still want to take advantage of the savings? Money blogger Andy at Be Clever With Your Cash has an awesome hack which will shows how anyone can get a student card for as little as £17.50.

Read at least one money book

Honestly, I know you already have a reading list as long as your arm, and more reading is the last thing you want to do.

But seriously – reading just one book on personal finances could be more valuable than hours of lectures.

You need to know the basics of money management. Starting now can make the difference between a secure, wealthy life or years of stress and worry.

And don’t think you have to commit to hundreds of pages of droning about the stock market. There are lots of excellent books now aimed at people like you, which will tell you exactly what you need to know in a concise and easy-to-understand way.

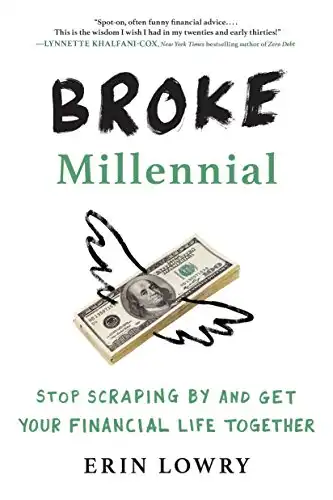

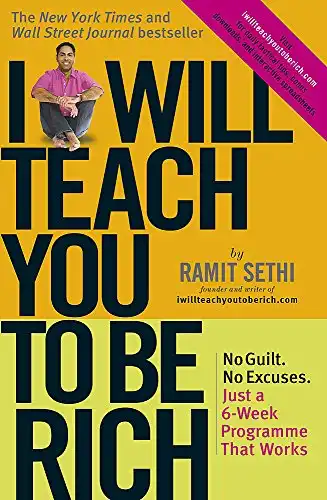

My top two picks are Broke Millennial: Stop Scraping By and Get Your Financial Life Together by Erin Lowry and I Will Teach You To Be Rich: No guilt, no excuses - just a 6-week programme that works. Both will take you through the absolute basics of everything from budgeting to bank accounts to credit cards to investing.

Are you off to university or college this year? What are your top money worries or tips?