How to improve your finances in 10 minutes or less

If you’re anything like me, you have a to-do list that would take you a year to get through.

You know there are loads of things you should be doing to improve your finances, but you just can’t get round to them.

Well, it’s time to stop procrastinating, my friend!

Here are 10 things you can do to improve your personal finances in 10 minutes or less. These are all things you can start doing right now that will make a real change to your money situation!

So if you have a few minutes to spare, pick one and get started – your bank balance will thank you!

1. Sign up with a cashback program

Cashback sites are one of my top money hacks. They are without a doubt the easiest way to make and save money.

Cashback sites give you money back on your online shopping. All you have to do is click through the cashback site before you make a purchase, instead of going directly to the retailer. Then, you shop as normal.

You can get cashback on anything from fashion to holidays to utilities providers.

Make it part of your routine to check a cashback site before you buy anything, and you’ll be making money effortlessly!

My favourite cashback site of choice is Top Cashback. It literally just takes a minute to complete your sign up, and it could make you hundreds over the next year.

Sign up here and thank me later!

2. Research a side hustle

If you’re serious about improving your finances, you need to make more money.

Making more money is the best way to improve your financial situation long term. It’s usually far more effective than making cutbacks to your budget.

You can use the extra cash to pay off debt, build an emergency fund, invest into a retirement fund, save for a down payment on a house, or so much more.

If you already have a full time job, you might think you don’t have time for a side hustle. But thanks to the internet, there are even loads of flexible jobs that you can do without leaving the house!

If you have 10 minutes spare today, why not start brainstorming ways to earn extra money? Here are some ideas to get you started:

- Babysitting

- Blogging

- Dog walking

- Freelance writing

- Virtual assistant

- Amazon FBA business

- Etsy shop

- Pinterest affiliate marketing

- Survey sites

- Make money watching videos on Emotion Miner

- Design T shirts on Merch by Amazon or Redbubble

- Uber driver

- Deliveroo driver

- Airbnb

- Cleaning

- Proofreading

- Flipping second-hand goods

- Publish an ebook

- Tutoring (you can do this in person or online)

- Pet sitting

- Gardening/lawn mowing

- Transcription work

You can also read through some of my blog posts for more ideas!

- 11 Tried-and-Tested Ways to Make Money Online in the UK

- How To Make an Extra £1000 Every Month

- 7 Simple Ways to Make Money on Amazon

- 4 Fantastic Ways to Make Money on Pinterest

- 9 Simple Side Businesses You Can Start This Weekend

- How to Start a Blog to Make Money

3. Get a free credit report

A credit rating is a kind of score of how trustworthy you are with money. Banks, car dealers and some stores all check your credit rating before they decide to lend you money or sell you something on credit.

If you’re looking for ways to improve your finances, it’s essential to keep an eye on your credit score. Problems with your credit rating now can cause big problems further down the line, for example if you want to apply for a mortgage in future.

Luckily, there are things you can do to fix a poor credit rating, but it’s worth staying on top of it now.

Several companies offer free credit reports so you can check up on your credit rating and get tips on fixing it!

If you have five minutes to spare right now, apply for your credit report so you know where you stand.

In the UK, you can apply for a free credit report from Equifax through Top Cashback and actually get paid to see your report! (Note, this is actually a 30 day free trial so remember to cancel it before the 30 days are up so you don’t end up paying.)

In the US, Credit Sesame is one company that provides free credit scores.

4. Set up automated savings

Is your current savings plan ‘I’ll save whatever’s left at the end of the month’?

Let me guess – there’s never anything left at the end of the month, is there?

One of the best things you can do is set up an automated payment that moves money from your main account to a separate savings account each month.

You’ll never have to think about saving again, and you’ll never accidentally spend that money, because it will be in a different account!

If you have online banking, this only takes 10 minutes to set up, so why not do it now? I recommend setting up a monthly automatic transfer the day after your salary hits your account.

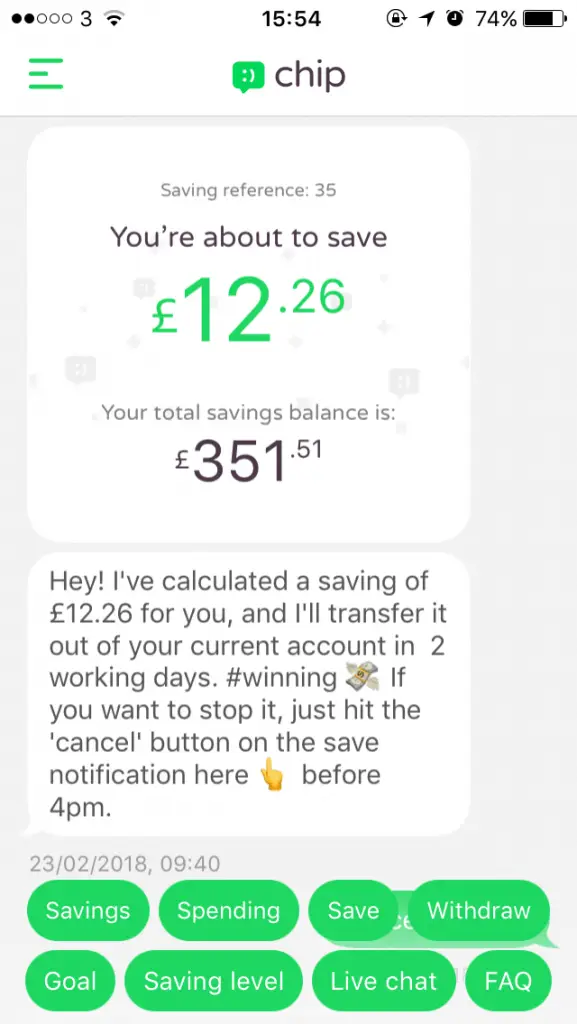

If you don’t already have a savings account, you could look into the Chip app. It sets up a savings account for you, and automatically moves small amounts over every few days. We’re talking £6.25 here, £12.50 there – much less painful than moving £200 in one go. You barely notice, but the savings build up fast.

The amounts saved are calculated by Chip based on your bank balance and spending habits, so it should always feel affordable. It tends to transfer higher amounts at the beginning of the month, and lower amounts at the end.

Of course, the app always notifies you before moving money. You can cancel or pause if money’s a bit tight.

At the time of writing you can get a free £10 when you sign up with a code and deposit at least £1. My code is CHIP-TZA033. Enter it in the “Promos & Referrals” section on your profile.

Having a savings safety net makes such a huge difference if you’re trying to fix your finances. You’ll feel more in control, and you’ll be much less likely to get into credit card debt. Please look into building up your savings now!

5. Start tracking your outgoings

If you don’t know where your money goes, how can you expect to improve your finances?

The simple act of writing down everything you spend money on has been shown to make us spend less. It’s the same idea as keeping a food diary if you want to lose weight. If you know you’ll have to write it down, you’ll think twice before spending money on spontaneous purchases.

Your money diary will also highlight areas where you’re leaking money – you might be shocked how much you spend on takeaways, magazines or snacks.

If you have a few minutes to spare right now, download a budgeting app (I use YNAB) or look for a spare notebook. Amazon has loads of cute budgeting journals, but any old notebook will do! You can even use the notes app on your phone.

I also have a post on free budgeting printables so you can just print out a useful budget planner and get started.

The next time you spend money, reach for your notebook or phone and jot it down.

6. Plan next week’s meals now

Meal planning is an easy and practical way to save money now.

Do you ever wander round the supermarket aimlessly, throwing everything that looks good in your basket, only to find out you don’t actually have enough for a balanced meal and have to run out again the next day? You need to plan your meals in advance!

So how to meal plan?

First, go through your cupboards and fridge, and write a list of what needs using up.

Now think of a few meal ideas to use everything before it goes to waste. This website will help you find recipes with whichever products you want to use!

What extra ingredients will you need to make those recipes? Write a list. Now stick to it!

Don’t forget to plan your packed lunches too.

Not only does meal planning save money, it can also save you a lot of stress and time on busy week nights.

7. Pick up a money book

According to multiple studies, one of the key traits of successful people is that they are committed to ongoing education.

If you want to improve yourself and your money situation, pick up a personal finance book instead of turning to social media the next time you have a spare five minutes.

I’ve done a series of book reviews here, but a couple of my current favourites are Broke Millennial: Stop Scraping By and Get Your Financial Life Together (a very readable personal finance 101), and The Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a Lifetime! (this will really fire you up to change your financial future).

If you don’t have so much time for reading, try out an Audible subscription for unlimited audio books!

You will be AMAZED how many books you can devour when you listen on your commute and doing chores.

8. Switch your utilities

According to Money Saving Expert, many families could save up to £5,000 by taking a day to do a full money audit – switching to cheaper utilities, cancelling forgotten direct debits and checking for unclaimed childcare vouchers, to name just a few things to look for.

If you have time, it’s well worth carving out a full day to go through all the advice on this page – it will likely be your best paid day of the year!

But even if you only have ten minutes right now, sign up with Switchcraft. This site will monitor the best gas and electricity prices for you, and switch you automatically if a better deal comes up.

It’s completely hands off, and some households could save up to £500 a year!

9. Declutter your home

Selling off things from around your home is one of the quickest ways to make extra cash.

Plus, having a good old declutter comes with added mental health benefits, such as lowering stress and giving you a sense of achievement.

You can sell on Facebook, eBay, Gumtree, local selling sites, boot sales, apps such as Ziffit or even on Amazon, depending on the type and quality of the goods.

Here’s a challenge you can do right now: set a timer on your phone for five minutes, and see how many unused items from your room you can gather up to sell.

Related post: How to Turn Your Old Books into Cash

10. Learn some DIY skills on YouTube

You can learn how to do literally anything from YouTube these days. Did you hear about the woman who built her own house with no experience following YouTube tutorials?

So how about you – what do you spend money on that you could learn how to do yourself?

From cooking to minor repairs to tiling your bathroom, search for some videos online and see if it’s something you could teach yourself.

For example, how much do you spend each month on haircuts? What if you could invest an hour into watching some videos, a few dollars in some professional hairdressing scissors, and save yourself hundreds over the next year? You won’t know until you try!

11. Bonus tip! Subscribe to Boost My Budget 🙂

Here on Boost My Budget I publish a new post every week full of tips and tricks to save money and make money from home. To make sure you never miss a post, sign up to my newsletter here and you’ll be notified every time I have a new article 🙂

Thanks for reading! What have you done today to make or save money?

Pin this for later