Looking to give your bank account a little boost? Enter the world of side hustles!

A side hustle is anything you do on the side of your main job to earn some extra cash. These days, more and more folks are hopping on the side hustle bandwagon to pump up their income and achieve their financial goals.

Despite the potential profits, the idea of setting up as self-employed and paying taxes puts a lot of people off.

But fear not! There are actually several tax-free side hustles in the UK that you do NOT have to declare to HMRC. For example: matched betting, selling your unwanted items, and earning cashback on your online spending.

In addition, you do not have to declare the first £1000 you earn from any other side hustle, and you can make an additional £1000 tax-free on income from your property – such as renting out a driving space.

- Make up to £40 with a free trial

- £250 earnings guaranteed!

- Personally tried and tested

- 150,000+ members

- 4.7 Trustpilot rating

Yes, you heard it right – these are all LEGIT ways to earn some extra quid without the taxman knocking on your door.

Now first, a disclaimer: I’m not a tax advisor. So, while I’ll share some knowledge and tips in this post, it’s not professional advice and it’s always wise to check with HMRC if you’re not sure whether you should be paying tax.

Alright, now that the serious stuff’s out of the way, let’s dive further into the world of tax-free side hustles!

Understanding UK taxes for side hustles

Alright, let’s get down to business and understand how the UK tax system plays into our side hustles.

In the UK, we’ve got two types of income: tax-free and taxable. Tax-free income is the stuff we earn that we don’t need to declare to HMRC.

On the other hand, taxable income is, you guessed it, the money we have to tell HMRC about and pay taxes on.

If you have a normal job with an employer, your income is most likely taxed before you even see it. You won’t have to think about filing a tax return or paying taxes, because it all happens automatically. This is the PAYE (pay as you earn) system.

But if you are self-employed or earn extra cash from other sources – even on the side of a full time job – you usually have to register with HMRC for Self Assessment, file a tax return and pay your own taxes on those extra profits.

If that sounds like too much of a hassle, I’ve got you covered!

There are some totally legal loopholes we can use to make a tax-free side hustle income WITHOUT having to register with HMRC or declare your income.

So, let’s roll up our sleeves and dive into the nitty-gritty of tax-free side hustles! 💪

Tax-free side hustles in the UK

Matched betting

Alright, let’s kick it off with my personal favourite side hustle – matched betting!

Now, you might be wondering what on earth matched betting is. First things first: despite the name, it’s not gambling.

Matched betting is a technique where we use the free bets and promotions offered by bookmakers to generate a profit. We use special calculators and tools, and ‘match’ our bets by betting for and against an outcome across two different sites – so we can’t lose.

The best part? You don’t pay any tax on matched betting earnings! That’s right – although it’s not gambling, HMRC sees it as such, and in the UK, gambling winnings are entirely tax-free.

Now, let’s talk figures. With matched betting, the potential earnings are pretty sweet. Typically, you can score an easy £600 or more in a few weeks from the sign-up offers alone! It honestly feels like free money falling from the sky.

And that’s not all – once you’re set up, you can rake in a steady £200-£300 per month – or even more if you are willing to invest the time and effort.

Matched betting is, in my personal opinion, the best side hustle in the UK for almost everyone. I’ve written loads about it – learn more here:

- Matched betting for dummies

- Is matched betting legal?

- How much can you make from matched betting?

- “No Risk” Matched Betting – How Does it Work and is it Really Risk Free?

- Make up to £40 with a free trial

- £250 earnings guaranteed!

- Personally tried and tested

- 150,000+ members

- 4.7 Trustpilot rating

Selling personal belongings

Let’s explore another fantastic way to make tax-free money: selling your unwanted belongings!

Here’s the deal: when we sell our used stuff – like clothes, electronics, furniture, or collectibles – we’re in luck! The money we make from these sales falls under the tax exemption radar.

The key here is that when you sell your own used items, you most likely sell them for less than you paid for them, meaning you don’t technically make a profit.

If I bought a dress for £40 and sell it the next year for £20, I didn’t make a profit – I made a loss. That’s why this income isn’t taxable.

The situation would be different if you are buying items specifically to sell at a profit, or making items to sell. Or, if you find yourself in possession of an antique or collectors’ item that sells for more than the purchase price.

In that case, you would have to pay tax once you exceed your £1000 trading allowance (more on that later!).

Don’t limit your selling to old clothes and electronics! Remember there are all kinds of weird things selling on eBay that you might at first think are worthless.

There’s a market for empty perfume bottles, branded shopping bags and cardboard boxes, empty jam jars, and even toilet roll tubes!

So, raid your wardrobe, attic, or garage and find those hidden treasures to sell. There are plenty of great places online and through local marketplaces where we can turn our pre-loved items into cold, hard cash. 💸

Some of the most popular platforms are eBay, Vinted, Depop, or Facebook Marketplace. Or trek down to a boot sale, if you’re old school!

Cashback

If you’re not already using cashback sites, why not?

When you shop online through cashback sites such as TopCashback, you get a percentage of your purchase back as cash.

This works because the cashback site gets money for referring you, and they pass a proportion of that money back to you. It’s like getting paid to shop – how cool is that? 😎

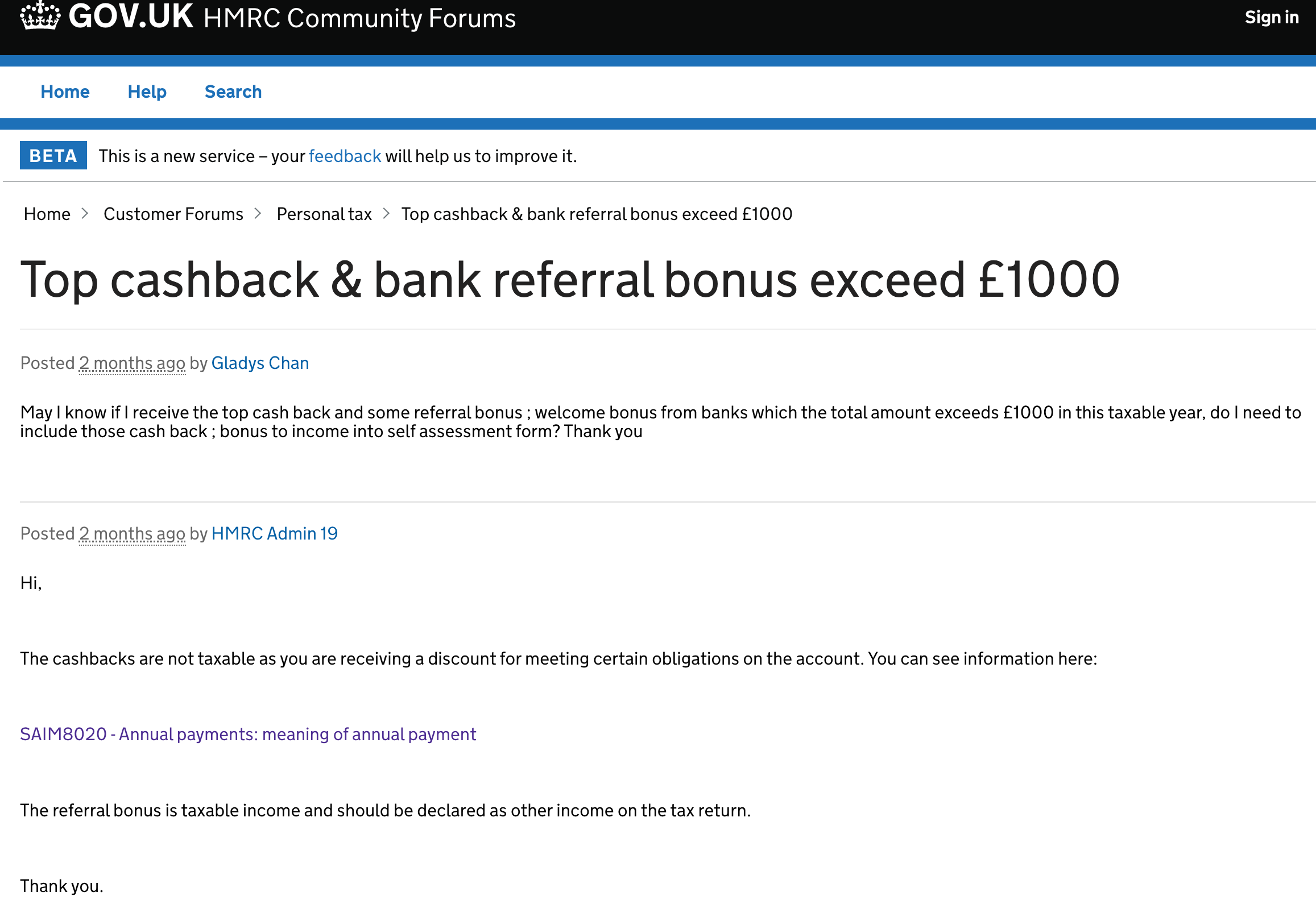

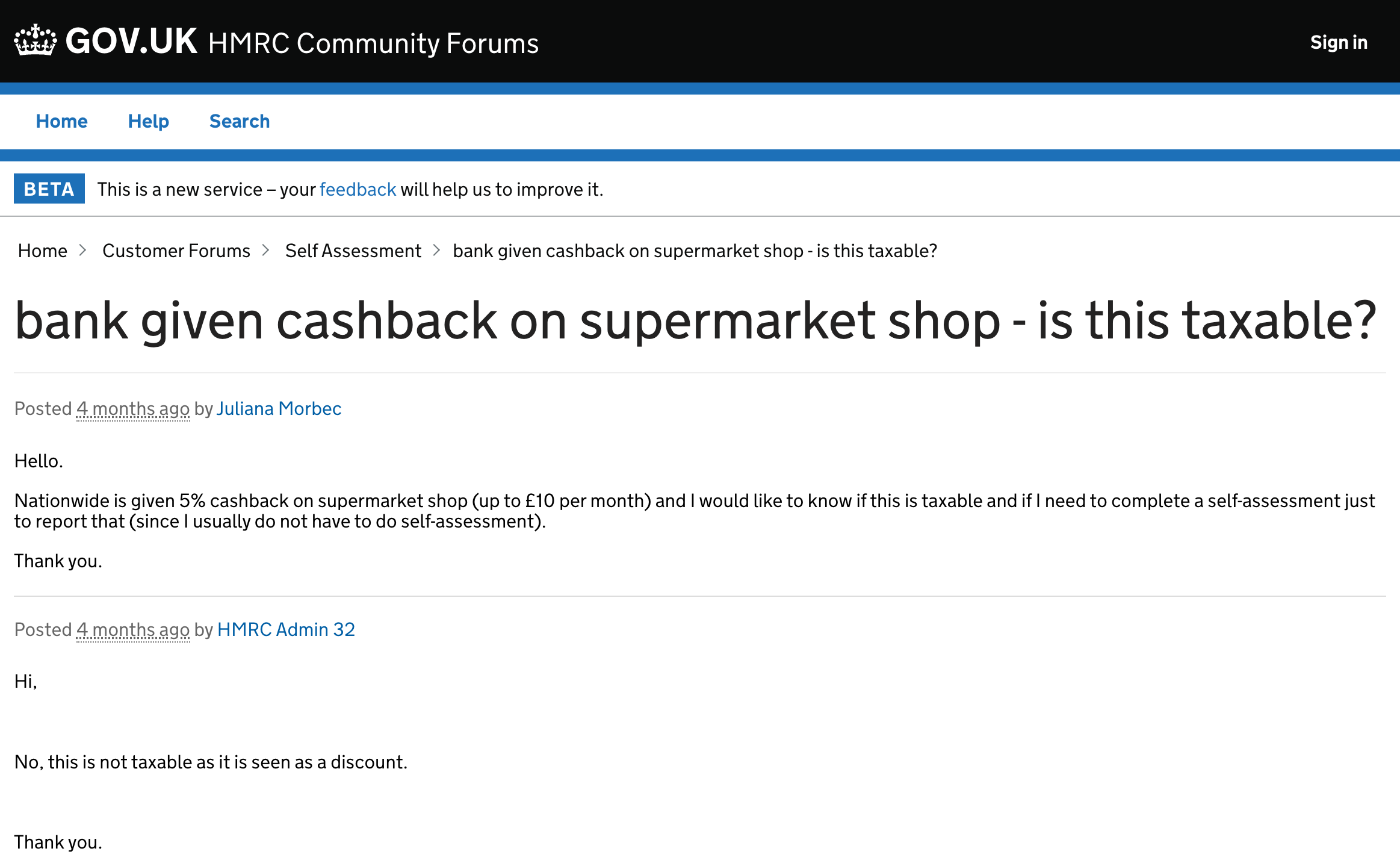

The best part is that HMRC considers this cashback to be a discount on the product, rather than income received. So, it’s entirely tax-free, and we can enjoy every penny without worrying about the taxman snooping around.

My go-to cashback site is TopCashback. You can earn huge bonuses on big purchases such as car insurance and internet packages – I earned £105 last time I changed internet provider!

But you can also earn cashback on small everyday purchases such as clothing, food delivery and DIY goods. Just get in the habit of checking TopCashback before you shop.

Most ‘get paid to’ sites such as OhMyDosh!, Swagbucks and Freecash also have cashback sections. It’s worth comparing, because the bonuses can vary.

And it’s not just cashback sites – the same principle applies to credit card rewards and air miles! When we rack up those points and rewards, we’re essentially getting discounts on our purchases or even freebies. So, still tax-free!

So, next time you’re eyeing that new gadget or planning a getaway, be a savvy shopper and use cashback sites and rewards to your advantage. You’ll save some cash and earn a little extra on the side – all without any tax hassle.

Rent out a room

If you’re lucky enough to have a spare room in your home, you can earn up to £7,500 per year tax-free thanks to the government’s Rent a Room Scheme.

You can take advantage of this scheme whether you’re the homeowner or a tenant (if your lease allows it). And it applies whether you have a permanent lodger, run a guest house, or simply rent out the room a few times a year on Airbnb.

The main criteria are that the room should be furnished, and you also need to be living in the property yourself.

First, check if you’re eligible for the Rent a Room scheme – all the info is on the gov.uk website. Once you’re in, it’s time to spruce up that spare room and get it ready for guests.

Now, before you start counting your earnings, let’s talk about the legal stuff. There are some obligations you need to be aware of – like safety regulations and ensuring your property is up to scratch. But don’t worry, it’s nothing too daunting.

The tax-free allowance will be halved if you share the income with your partner or anyone else living under the same roof.

All in all, the Rent a Room scheme is a fantastic opportunity to monetise that spare room while avoiding the tax headache. So, if you’ve got some space to spare, it’s time to consider becoming a hospitable host and earn some extra cash along the way!

Earn up to £1000 tax-free from ANY side hustle thanks to the tax-free trading allowance

If you earn less than £1000 per year from any other side hustle, you do not have to tell HMRC or pay tax.

This is because of the Trading Allowance – a little gem that permits anyone who wants to make a bit of extra cash on the side to do so without having to worry about HMRC.

This is designed for anyone who makes a casual income from occasional freelancing, online money making sites, reselling, babysitting, gardening, dog sitting and so on.

You can pretty much do any kind of side hustle you like within the £1000 trading allowance, but if you’re stuck for ideas, let me share some popular options with you:

- Online surveys: not the highest-paying side hustle in the world, but a fun and easy activity you can do while watching TV or stuck on the bus. You are unlikely to make more than £1000 per year with surveys, so you shouldn’t have to worry about tax.

- Get Paid To sites: on these sites offer loads of different ways to make money online, such as surveys, cashback, watching videos, completing sign up offers, downloading apps, even playing games! My favourites are OhMyDosh, Freecash and Swagbucks.

- Rent out your belongings: hire out equipment such as power tools, sewing machines, bicycles and more. There are loads of sites for this (that offer insurance and security checks), such as Fat Llama.

- Freelancing: got a skill? Use a freelance marketplace such as Upwork to find someone to pay you for it. You can offer freelance services in pretty much anything, but popular ideas are writing, graphic design, web development, translation, photo/video editing, marketing, social media management, and coding.

- Online tutoring: with the rise of e-learning, there’s a growing demand for online tutors in various subjects. Even if you don’t have a specialist subject, you can offer English conversation practise to foreign students – learn more here.

- Reselling: we already talked about selling your own personal second hand items. But if you really take a shine to the eBay life, you might decide to source your own items to resell – whether that’s scouring charity shops for bargains, or importing specialist goods from China or elsewhere. Since you are buying and selling for profit, this scenario would be taxable if you make over £1000 in a year – but of course the first £1000 is tax free under the trading allowance.

- Photography: if you have a passion for photography, you can sell your photos on stock photography websites or offer photography services for events and portraits.

These are just a few ideas to get you started, but you will find dozens of other ideas on my posts on side hustle ideas and how to make extra cash in the UK!

Remember, while the Trading Allowance lets us enjoy tax-free income up to the £1000 annual limit, it’s still essential to keep track of your earnings.

Once you go beyond the £1000 threshold, you will have to declare it. So you might choose to limit your activities to £1000 in order to avoid the hassle of registering with HMRC, or you might choose to reach for the stars and pay tax on any additional earnings.

Either way, keep good records so you know what’s what.

Earn another £1000 tax-free with the property allowance

There is actually another kind of tax-free allowance, and that is the Property Allowance. This one allows you to make up to £1000 tax free from your land or property. You can use this in addition to the Trading Allowance.

This is slightly different from the Rent-a-Room scheme we discussed above, because to qualify for that, you also have to be living in the property yourself.

The £1000 property allowance applies when you make money from any property or land that you own, even if you don’t live there. For example, if you have a second home that you rent out.

A more realistic way that the average person could profit from this is renting out your driveway! There are plenty of sites such as JustPark that help you do this. If you live near a town centre, station, sports ground etc you could be quids in!

Other examples could be renting out a garage or outbuilding, a caravan pitch, studio/workshop space, and so on. It all depends what space you have available.

What happens if I go over the tax free allowances?

So what if you end up surpassing the tax-free allowance? Well, that’s awesome – it means your side hustle is doing well!

Unfortunately it does also mean you will have to start paying tax now on your side hustle earnings (unless your side hustle is one of the exemptions listed above: matched betting, selling personal items, cashback or renting a room up to £7,500 per year).

Here’s what you need to know.

If your side hustle earnings exceed the tax-free threshold, you’ll need to register as self-employed with HMRC, and also register to do a Self Assessment tax return.

Registering online

Don’t fret; it’s a straightforward process! You can do this online on the HMRC website, and it’s better to do it sooner rather than later to allow time to get it all set up.

Once you’re registered, you’ll (eventually) need to fill in a self-assessment tax return. The deadline is usually 31st January of the year following the end of the tax year that you earned the money, so that’s plenty of time.

Now, I know the word ‘tax return’ might sound intimidating, but it’s not as scary as it seems! The form will ask you to declare your income and any allowable expenses related to your side hustle. Then it will tell you how much you owe.

The trick is to be organised and keep track of all your income and expenses throughout the tax year. You can do that with a simple spreadsheet – there are plenty of free templates online.

That way, when the time comes to fill in the self-assessment form, you’ll have all the info you need at your fingertips.

Don’t forget to save

It’s also important to remember to set aside some money from your side hustle earnings to cover your tax bill. Unlike your PAYE day job, nobody else is doing it for you, and you have to pay it all in a lump sum at the end of the tax year!

It’s easy to forget about taxes when you see the money rolling in, but you don’t want to be caught off guard when it’s time to pay. By saving a portion of your earnings throughout the year, you’ll be prepared to meet your tax obligations without any stress.

FAQs on tax-free side hustles UK

The tax-free allowance for side hustles in the UK is £1,000 per tax year for trading allowance, and an additional £1,000 per tax year for property income.

Yes, you can have multiple tax-free side hustles simultaneously as long as the combined income stays within the £1,000 allowances. Additionally, there are tax-free side hustles that you do not have to declare no matter how much you make, such as matched betting.

The ‘Rent a Room’ scheme has a £7,500 tax-free threshold per year. Sharing income with others in the same property will halve the allowance.

Registering as self-employed is not necessary for tax-free side hustles within the £1,000 allowance.

If your side hustle exceeds the tax-free threshold, you’ll need to register as self-employed, complete a self-assessment tax return, and pay taxes on the excess income. HMRC will tell you how much you need to pay once you’ve completed your self-assessment.

Failure to report taxable side hustle income can result in penalties, including fines and interest on unpaid taxes. So make sure to record all your income and expenses, and declare it once you go over £1000!

How to make tax free money UK

So to sum up, there are several ways to make tax free money in the UK. Options like matched betting, selling your belongings, and getting cashback on purchases can boost your income without paying taxes.

And don’t forget about the amazing £1000 tax-free trading allowance too! It’s perfect if you just want to dip your feet in the side hustle pool without the stress of dealing with HMRC.

However, if your side hustle earnings go over the tax-free limit, you’ll need to register as self-employed and fill in a tax return. Make sure to keep records, set aside money for taxes, and seek professional advice if needed.

So, whether it’s matched betting, selling your stuff, cashing in on cashback deals or more, you can enjoy all the benefits of tax-free side hustles knowing that it’s all legit. Happy hustling! 🚀

Related posts

- 54+ Sure-Fire Ways to Make Money From Home in the UK

- How to Make Extra Money in the UK: 91 Ways to Make Extra Cash

- How To Get FREE Money In The UK