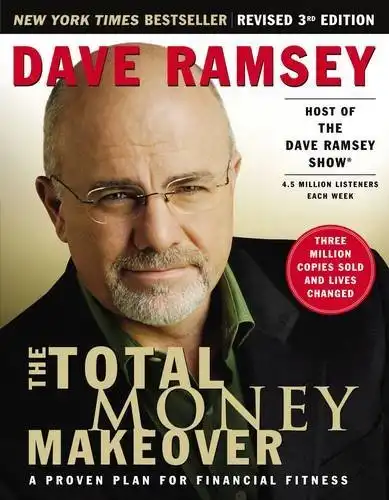

This month’s book review is The Total Money Makeover: A Proven Plan for Financial Fitness by Dave Ramsey.

The Total Money Makeover is one of those personal finance classics that you keep hearing about over and over again. For some reason it never really appealed to me – I think Dave Ramsey is a very particular character and you either love him or you don’t!

Anyway, as part of my efforts to educate myself in personal finance and read through all the best-known books, I thought I should give him a try.

Dave Ramsey is best known for his famous ‘baby steps’, and this book is where he sets them all out. The ‘baby steps’ are designed to lead anyone out of debt and set them on the path to wealth.

Dave is adamant that anyone can achieve wealth, no matter where they’re starting from. Yes, even if you’re tens of thousands of pounds in debt.

The baby steps are:

- Baby Step 1 – Build an initial emergency fund of $1,000

- Baby Step 2 – Pay off all your debts except mortgage using the debt snowball technique (smallest debt to largest)

- Baby Step 3 – Build up your emergency fund to 3-6 months expenses

- Baby Step 4 – Invest 15% of your income into retirement savings

- Baby Step 5 – Save for your children’s college funds

- Baby Step 6 – Pay off your home early

- Baby Step 7 – Build wealth, donate and enjoy your money

The book is definitely aimed at people starting from a place of debt. In theory I guess you could start at any point and just skip the first few steps if you’re starting from a more comfortable position. Still, I think a lot of the system counts on building momentum. The idea is that you use the excess money once you’ve cleared your debts to put into investments. The ‘snowball method’ for paying off debt and his strategies for building your emergency fund are what makes the Total Money Makeover unique. Once you’re debt-free, the saving and investing advice is pretty standard – so you wouldn’t necessarily benefit from choosing this book over any other.

I think The Total Money Makeover: A Proven Plan for Financial Fitness is based on really solid advice and I know that the baby steps have changed so many people’s lives.

However, I did find Dave Ramsey’s style a bit grating to read – but that’s just my opinion.

Ramsey’s very much about the ‘tough love’ and he does not hold back from calling people who don’t follow his advice ‘dumb, dumb, dumb’. I get that some people need the kick up the bum and some people obviously find him very inspiring! It just felt a bit much to me.

Also, almost every other page is a testimonial from people who’ve apparently been through a money makeover of their own and are singing Ramsey’s praises. Some of these stories are truly inspiring and to start with I did enjoy reading what people had achieved.

However, by the end I was just skipping these as they got very samey. Also, a lot of them basically seemed to be written to advertise Ramsey’s other books and programs, like his Financial Peace University.

As a final note, Dave Ramsey is VERY Christian. The book is scattered with Bible verses and references to doing things ‘prayerfully’. The book and system itself is not necessarily aimed just at the Christian market and you can easily skip over those bits if you’re not too bothered. But I did feel, as an atheist Brit, I just felt a bit of a culture clash reading this very American, Christian book!

Boost My Budget Rating

4/5

I know this review has come across a bit negative but I do genuinely think The Total Money Makeover: A Proven Plan for Financial Fitness is a very useful and practical strategy for people trying to get out of debt! I’ve read enough other reviews and testimonials from people who’ve followed the system to know that it works. Just be aware that Dave Ramsey has a love-it-or-hate-it writing style and pulls no punches. If you are in his target market (in debt, guided by Christian principles, American?) I would definitely recommend picking this up.

Next month’s book is Happy Money: The New Science of Smarter Spending by Elizabeth Dunn and Michael Norton.

Previous reviews:

- Your Money Or Your Life by Vicki Robin and Joe Dominguez

- Rich Dad Poor Dad by Robert T. Kiyosaki

- Millionaire Teacher by Andrew Hallam

- The Millionaire Next Door by Thomas J. Stanley and William D. Danko

- Get Rich, Lucky Bitch! by Denise Duffield-Thomas

- I Will Teach You to Be Rich by Ramit Sethi

- The Richest Man in Babylon by George S. Clason

- Broke Millennial by Erin Lowry

My to-read list:

- The Wealthy Barber by David Chilton

- The Minimalist Budget by Simeon Lindstrom

- Early Retirement Extreme by Jacob Lund Fisker

- The Automatic Millionaire by David Bach

- It’s Not About The Money by Brent Kessel

- The Millionaire Mind by Thomas J. Stanley

- A Random Walk Down Wall Street by Burton G. Malkiel

- Rich Bitch by Nicole Lapin

- Money, A Love Story by Kate Northrup

- You Are a Badass at Making Money by Jen Sincero

- Nice Girls Don’t Get Rich by Lois P. Frankel

- The Millionaire Fastlane by M.J. DeMarco

- How to be a Financial Grownup by Bobbi Rebell

Any more recommendations? Let me know!