Contributed post

Of course, while buying a house, one wants to be as cost-efficient as possible. Not only during the initial sale, but often during the aftermath of setting everything up and possibly looking to resell it. While this is rather obvious, many people often just try to hop onto the property train without much thought and think that their savings will take them far enough for everything to be ok. Sadly, that is very rarely the case, savings get spent prematurely on various things, such as wine for a small celebration or even taking out the garbage and debris from the building works in giant skips. Everything ends up costing money eventually, and without making some smart and calculated decisions along the way, you will probably find yourself in quite an unfavourable situation. Without any further ado, let us go and explore a few ways in which you can be prepared for your future property purchases.

Timing is important

Much like anything else on the market, the pricing of housing and property differentiates over the span of a year or two. Of course, there is never a surefire way of getting your house as cheap as possible at the best price imaginable because you never really know when something is going to drop or rise in value. However, one thing you can do is stay well informed on the topic, read articles about what is going on in the property world, keep tabs on prices yourself both online and in estate agents, and generally just stay on top of the situation. With some research prior to your potential purchasing of property, you are sure to start seeing some trends in property prices across the country and will be able to effectively judge when the time is right to finally pull the trigger on the purchase. Once again, nothing can ever be guaranteed, but using your now-educated and better judgement you can probably snag a better deal here and there without much effort.

Prepare for the worst, hope for the less bad

Now, getting your hopes up and hoping for the absolute best case scenario is probably more than unreasonable, especially in this day and age, but it doesn’t mean that one cannot be realistically optimistic. No matter how much you are usually berated for being overly cynical or pessimistic, this time it might just come in handy. Saving up extra money for the whole ordeal is probably one of the smartest and wisest decisions you can do in this scenario. Extra expenses always tend to manifest themselves at the least likely and least wanted times, so having a few thousand in surplus would not hurt at all. The process of buying the house is nowhere near over the moment you pay the down payment, so many more things start popping up as soon as you start working on the house. Be it something minor like repainting the walls or getting a new sofa, to completely redoing the whole interior, unexpected things like bulging walls, deformed floorboards, holes in the wall or leaks, they all require fixing. Which then, in turn, requires money, for materials for yourself to use and handle the situation, or to hire someone to do it for you, either way, it’s going to cost you.

Quick rundown of the process

Unlike many other things which you can just go and take off the shelf then more or less instantly take it home the moment you’ve paid the price, buying a house could not be further from the average process. There are a few more steps involved in this case, and unless you are prepared to tackle them, you probably will find yourself lost at one point or another. Let’s start with the very beginning, and see if you should do anything before you make the actual purchase. Should you sell your current property? Decide on a reasonable budget for the potential purchase, then see if that lines up well with the kind of mortgage you would want. If you have not bought property before, then its worth looking over some first time buyer solicitor prices to give yourself a much needed introduction. Choose a specific property which you wish to buy, and make them an offer for it. Hopefully, it will get accepted. If it does, you can go ahead and starting arranging your mortgage. When that’s done, hire a conveyancer or a solicitor to legally transfer the ownership of the property to you. At this point, you will need to pay a (usually) 10% deposit for the property as a down payment, after that all that’s left is exchanging contracts and getting all those final negotiations and arrangements out of the way. It really is a bit of an ordeal compared to just buying something from the local corner shop, but that’s just the way it is.

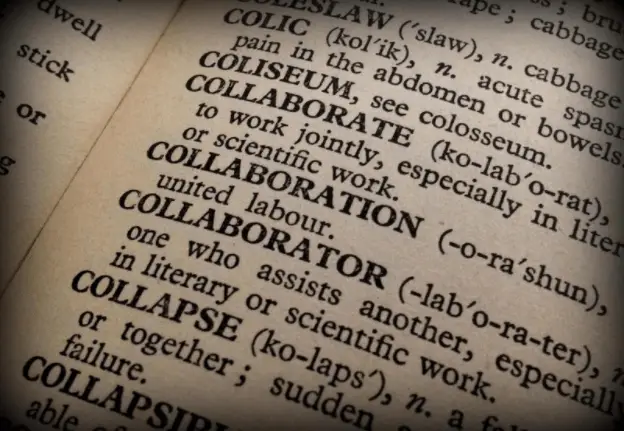

Get familiar with the terminology

Before you dive straight into the buying and the moving, you need to get familiar with the relevant terminology to not make any silly mistakes later down the line. The most common ones are somewhat self-explanatory, for example, “estate agent” or “contracts”. However, there are some which are nowhere near as straightforward, and often bring a distinct look of confusion to most people’s faces. In case you were ever wondering, what “gazumping” or “gazundering” meant, then you are not alone. Sometimes even simple words which we all know and use in everyday life, take on a completely different meaning in this context. Words like “redemption”, “title”, “premium”, “excess”, “charge” or even “capital”, amongst many others all mean something rather different in the context of real estate. If you wish to study up and have an excellent reference point to any possibly unknown terminology that may be thrown your way then feel free to have a read of this comprehensive article. It explains more than you will probably ever need, but you can never be too sure of what things you might have to deal with on your way to becoming a property owner.